Small Business? Better be able to prove it

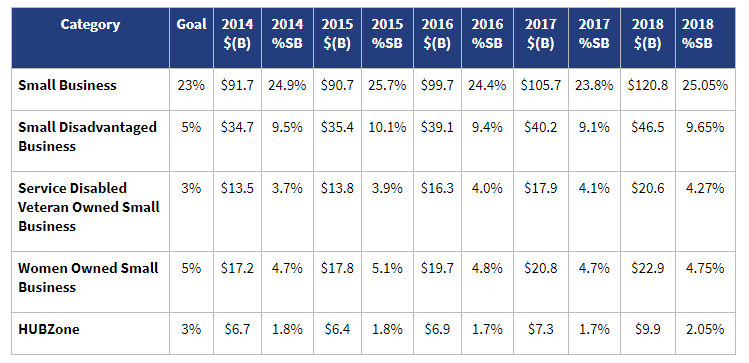

The Small Business Administration has contracting assistance programs, in place, to help small businesses by limiting competition for certain government contracts. Additionally, they work to ensure at least 23 percent of all federal contracting dollars goes to small businesses. (JD Supra August 13, 2021)

The current SBA programs are:

- The small business set-aside program

- 8(a) Business Development (8(a)) Program)

- Service-Disabled Business (WOSB) Program

- Historically-Underutilized Business Zone (HUBZone) Program (ibid)

It has come to light that some of these programs have had issues certifying and monitoring participants of the programs. Recently, two inspectors general audited the HUBZone and SDVOSB programs. The audits showed 15 of 39 firms receiving HUBZone certification and a HUBZone contract. Of the 15, three were improperly certified to participate in the program. The SBA had not made an eligibility determination for four others participating in the program. (ibid)

The Department of Defense (DoD) Office of Inspector General (DoD-OIG) recently issued a report that turned up concerns with how DoD confirms eligibility for SDVOSB contract awards. In the report, 29 SDVOSB contractors were audited. 16 contractors at issue received 27 contracts, together with values at $827.8 million. Those 16 contractors “did not have a service-disabled veteran as the owner and the highest-ranking officer of the company or whose publically available information and contract documentation did not support that the contractor met the requirements for SDVOSB status.” (ibid)

Since the issues have come out, both criminal and civil enforcement has increased. There have been four federal indictments or guilty pleas from business owners who misrepresented their status as a small business, women-owned business, service-disabled veteran-owned business, or minority-owned business. These are all clear-cut cases of misrepresentation and fraud. Recently, a construction company obtained $250 million in government contracts set aside for SDVOSBs. The owner of the company put a disabled veteran as the apparent owner of the construction company to qualify the company as an SDVOSB. The true owner turned out to be a non-service-disabled business partner who controlled both the financial and operational control of the company. This type of fraud is known as a “rent a vet” scheme. (ibid)

The government may use the False Claims Act (FCA) (31 U.S.C 3729-3733) to root out contractors who violate small business compliance laws. The FCA has a whistleblower aspect allowing for whistleblowers to obtain a percentage of the government’s recovery from a successful resolution of the matter. The FCA is a civil enforcement statute that does not require specific intent to defraud. The reach of the FCA is broad and not to be taken lightly. (ibid)

In 2020, there were 8 key settlements, rulings, and filings regarding various small business fraud scheme allegations and five settlements in 2021 already. Just last month a Virginia-based consulting group and the president of the company agreed to pay a $4.8 settlement regarding FCA allegations. The recent civil enforcement should be a flashing light of warning to small business government contractors that inspectors general and the DOJ are actively pursuing contractors who know their actions are in violation of small business contracting rules. (ibid)

To stay compliant and reduce risk, the following guidelines should be followed:

- Establish a company culture of compliance, with every employee understanding the rules

- Work with subject matter experts to stay informed

- Continuously verify the company eligibility in the program

- Assess the eligibility of subcontractors or affiliates

- Perform comprehensive and thorough compliance risk assessments (ibid)

Following the guidelines will allow small businesses to spend their resources on participating in government contracts and not on criminal/civil violations.

Trying to determine if you meet the guidelines? Give us a call.