With modernization comes small business opportunities

On July 29, the Senate passed the Promoting Rigorous and Innovative Cost Efficiencies for Federal Procurement and Acquisitions (PRICE) Act to modernize the federal acquisition process and expand contracting opportunities for small businesses. This legislation encourages the execution of innovative new systems and procedures while allowing small businesses to grow their businesses through federal contracts. (Federal Soup August 2, 2021)

The objective of the Price Act is to address long-standing obstacles facing small businesses attempting to contract with the federal government. The Act goes so far as to require federal agencies to report on how they plan to improve mission outcomes and increase small business participation in government contracting. (ibid)

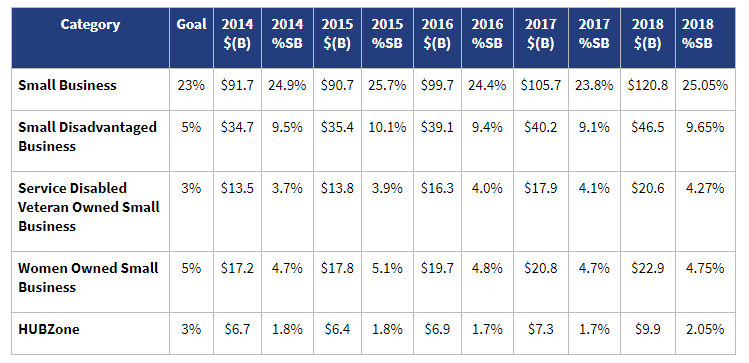

The PRICE Act passage directly follows a white house objective to direct $100 billion toward small disadvantaged businesses by expanding federal contracting opportunities. (ibid)

Are you a woman, minority, veteran-owned, or small disadvantaged business with contracting questions or experiencing hurdles that are hard to overcome? Give us a call.