FY 2021 SubK Reporting Deadline Extended

The Small Business Administration (SBA) is extending the period for subcontract reporting for fiscal year 2021. The extension allows Federal Contractors (FCs) extra time to correct any issues experienced during the pandemic as well as Federal Agencies (FAs) extra time to review the reports. This will be the final Subcontract Reporting extension. The timeframe for FCs to revise rejected reports is not extended and remains unchanged. (Small Business Administration Notification March 5, 2021)

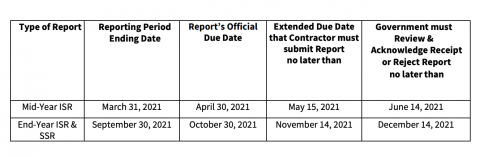

Extensions provided by the SBA include:

- 15 days for FC’s report submission due dates and for the FA’s review periods for the FY 2021 ISRs and SSRs

- 45 days after the end of the reporting period for FCs to submit their ISR and SSR and 45 days after contract completion if applicable

- 75 days from the reports’ ending dates for FAs to acknowledge receipt or reject the initial reports

- 30 days after receipt of a rejection notice, per FAR § 52.219-9(l), for FCs to revise rejected reports

- 30 days after submittal for FAs to review revised reports

The subcontract report extensions are effective immediately. This pdf contains the formal notice SBA provided for the extension notification. (ibid)

Have questions concerning your ISR or SSR or a rejected report notice? Give us a call.